Sometime between May and July of this year the data of the credit monitoring agency Equifax was breached—but the incident was not reported to the public until Sept. 7th.

Holding the company accountable for their actions and showing a concern for citizens safety has taken a backseat to other pressing news. It almost seems as if Equifax just got a little slap on the hand and has been set free of any wrong doing, while millions are in jeopardy. American citizens should be requesting more repercussions for situations like these.

Approximately 143 million Americans have become a victim in the Equifax hack. The population of the US is 323 million people but 78 million are under the age of 18, so that means approximately 58 percent of adult Americans have been affected. Their most private information is now on the so-called “dark web” and could be sold throughout their entire adult lives to anyone at anytime.

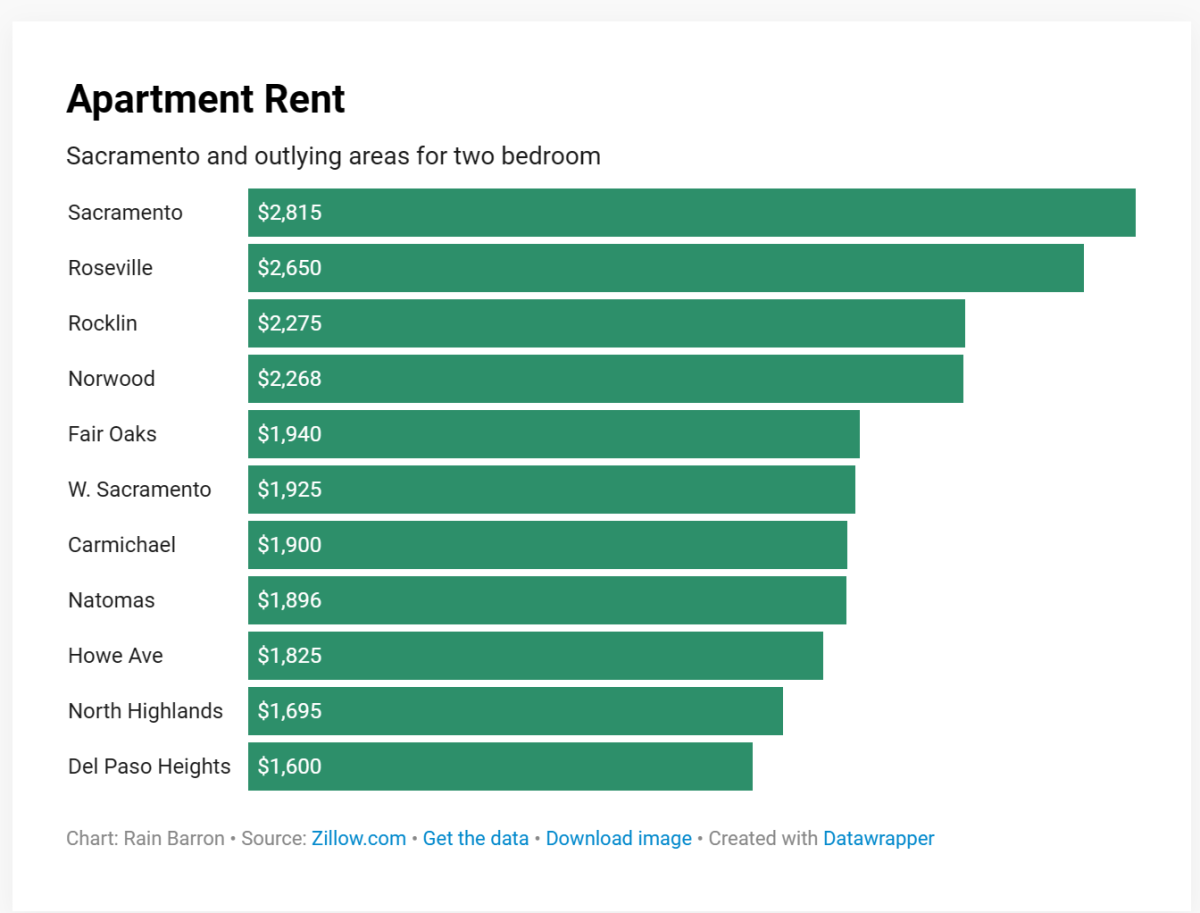

You may not think much of your credit report now but maybe at some point in your life you might consider buying a home or making a large purchase that requires taking out a line of credit. When your lender pulls your credit report and finds that you have multiple loans out already and your score won’t be good enough to earn you an approval.

It’s enough information that someone on the dark web can open a line of credit at anytime throughout your life and damage your credit. Someone who has your social security number can take a job, file your taxes and even claim your kids as dependents and receive your refund before you even file a tax return. The implications can complicate a person’s life severely and can take years to repair.

Unfortunately there isn’t a new identity that can be given to an individual once identity has been stolen. No one changes their birthdate or social security number—so thieves can continue to take out debt, in your name, for the rest of your life.

This breach was a result of a standard security patch that needed to be updated and was available to use. Equifax did not install the update and allowed a window of opportunity for hackers.

It is also suspected that Equifax is profiting off of this breach. When news of the breach was released to the public, Equifax offered additional protection for consumers “Lifelock, another credit monitoring company has now seen a tenfold increase in enrollment since Equifax announced the breach according, to filings with the FTC [Federal Trade Commission], Lifelock purchases credit monitoring services from Equifax and that means someone buys credit monitoring through Lifelock. Lifelock turns around and passes some of that revenue directly to Equifax. From the second Equifax announced this data breach, Equifax has been making money off of consumers,” said Senator Elizabeth Warren in the senate data breach hearing, held on Oct. 4th of this year.

Equifax says it discovered the breach on July 29th. Three days later, Equifax Chief Financial Officer, John Gamble sold 6,500 shares of Equifax stock for roughly $946,000.

Equifax’s president of US information solutions sold 4,000 shares for $584,000, a day later Equifax’s President of workforce solutions sold $250,000 worth of stock and none of these trades were scheduled. According to the FTC.

Equifax denies the executives had any knowledge of the breach at the time but what executive of a major company like this would not have this kind of pertinent information?

The cost to Equifax is small considering they profit far more from breaches. The company doesn’t have a reason to protect consumers information because there is no accountability. The people are not the consumers they are the product.

Perhaps a first step should be mandating disclosure rules. The European Union rules mandated disclosures within 72 hours of discovery. Somehow in the U.S its completely legal to wait almost two months to let the public know their information has been leaked.

In 2015 Congress couldn’t even get on board to mandate a 30-day disclosure minimum for breaches. Most people can’t think of a single good reason why this information should be kept for so long however 40 days is plenty of time mitigate stock market losses or even profit.

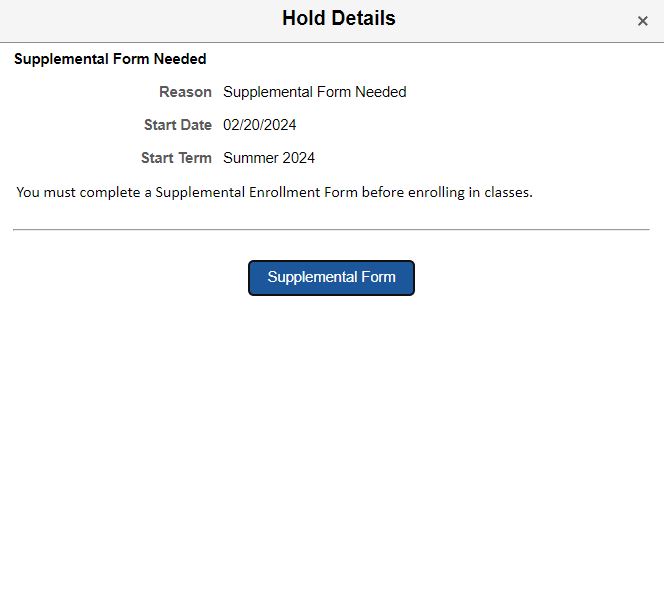

It is important to find out if your information has been leaked and go to all three reporting agencies and freeze your credit. This will prevent learners from getting scores which will not allow anyone to open credit in your name.

Equifax should no longer be allowed to hold our information unless it can prove it can protect it.