Let’s get straight to the facts; America is suffering from the “Big C.” No, not cancer–consumerism, and with the current state of the economy and the holidays coming up, America needs to put a halt to its excessive desire to spend money it doesn’t have.

According to the U.S. Census Bureau, the unemployment rate is 9.1 percent in the United States, 12 percent in California, and 46 percent of Americans are living in poverty, which is a good reason to quit spending money or at least to get a job so you have money to spend. Keeping up with the Joneses is an attitude that we’ve had for a long time. There is a rush, an urgency to buy the latest gadgets no matter the cost.

Marketing professor Dr. James Roberts says in an Oct. 31 article with Time Magazine, “We’ve perverted the little white house with the picket fence and the car in the driveway to the 3-car garage with a Hummer out front, the 3,000-square foot house and jewelry and everything that goes along with it. It’s the American dream on steroids. Today we want the easy wealth without the work.”

One would think living in poverty and not having a job would stop people from spending money, but it doesn’t. According to Gallup.com, shoppers spent an estimated $638 in 2010 during the holidays and are expected to spend $714 this year; a 7 percent increase.

Winter holidays are the biggest supporters of consumerism offering gadgets at lower costs than the rest of the year. Department stores use days such as Veteran’s Day, Thanksgiving, and Black Friday as excuses to run out and buy things. Everything is on “sale” for a limited time only and people only want the best for themselves and their families for Christmas.

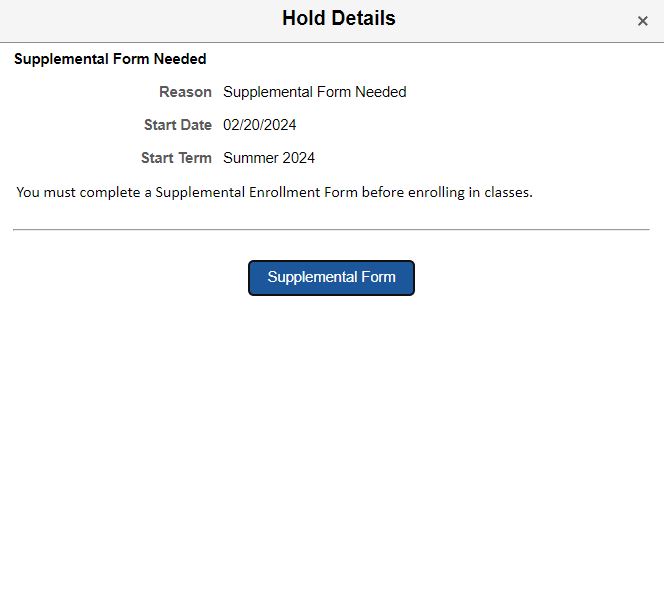

After five years, Wal-Mart is bringing back layaway. Shoppers can now hold items such as toys and electronics until mid-December. To qualify for layaway, customers have to spend a minimum of $50 and each item has to be worth at least $15. A $5 fee is necessary as well as putting 10 percent down. To top if off, the balance must be paid by Dec. 16 or the consumer faces a $10 cancellation fee. This is only one way that people can save money for the holidays; the other is a certain Friday.

Black Friday is taking over the holidays with stores opening as early as 10 p.m. Thanksgiving night, that’s seven hours earlier than usual. Forget spending time with your families, America says get out and hit the shops as soon as possible. Apparently buying products is more important than giving thanks. This year shoppers spent $11.4 billion in retail stores, which is up 6.6 billion dollars from last year according to Shoppertrack.com and it’s the largest increase in Black Friday shopping since 2007. Congratulations Americans, consumerism is running your life.